OVERVIEW: Federal Spending, Taxes, Deficit

This page will be available to paid subscribers only beginning February 1, 2026 (only $8/month or $50/year).

Note from the author: The numbers for FY 2026 (which began October 1, 2025) will be posted in February 2026 after the Congressional Budget Office releases its annual budget and economic projections for FYs 2026 – 2036. At the present time, the discretionary spending numbers for FY 2026 are unclear because the House and Senate have not yet arrived at “topline” numbers for the nine unfinished appropriation bills. Consequently, the following budget overview reflects approximate FY 2025 spending and revenues.

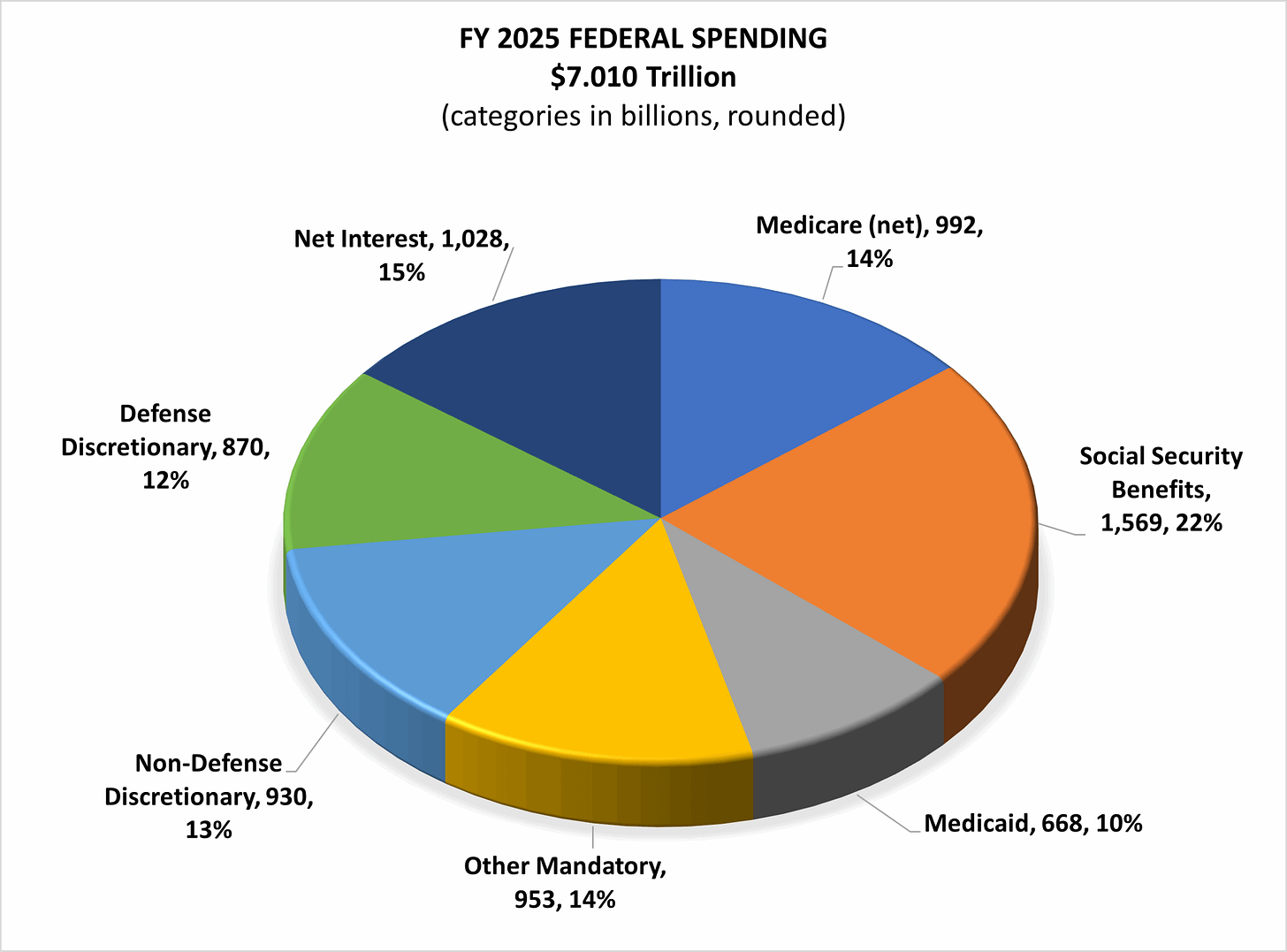

FEDERAL SPENDING

The federal budget divides more than $7 trillion in annual federal spending into three broad categories as displayed below:

discretionary spending;

direct spending (Social Security, Medicare, Medicaid and other mandatory spending); and

net interest payments on the debt.

Data Source: Congressional Budget Office Baseline and End of Year Summary

(Numbers will be updated when the CBO Budget and Economic Outlook is released in January 2026.)

Discretionary Spending: 25% of the Budget:

About 25% of federal spending is called “discretionary spending,” because the amount of spending flows from annual discretionary funding decisions by the House and Senate Appropriations Committees.

Defense discretionary spending was about $870 billion in outlays for FY 2025, or 12% of total outlays. It is funded by the Defense Appropriations Act and other appropriation laws that fund military construction and atomic energy. (The Department of Defense has also received an additional $150 billion in mandatory spending available through FY 2029 from the OBBBA law signed in July 2025).

Non-defense discretionary (NDD) spending was about $930 billion in outlays for FY 2025 or 13% of total outlays. NDD is funded by the 11 non-defense appropriations laws. Non-defense discretionary spending has been trending downward, except for temporary increases due to the Great Recession and COVID-19 response efforts. As a percent of GDP, non-defense discretionary spending was 4.4 percent in FY 2010 and fell to 3.1 percent of GDP by FY 2019. Due to the COVID-19 pandemic response, NDD rose to 4.4 percent of GDP in FY 2020, but fell to 4.0 percent in FY 2021, 3.8 percent in FY 2022, 3.6 percent of GDP in FY 2023, 3.3 percent of GDP in FY 2024, and about 3.1 percent of GDP in FY 2025.

Direct (Mandatory) Spending: 60% of the Budget

The largest block of federal spending— about 60% and $4.182 trillion in FY 2025—is called “direct spending” because the outlays flow directly from legal obligations of the federal government established in authorizing laws. Direct spending is also referred to as “mandatory spending” because it is mandated by legal obligations written into permanent law (such as Social Security benefits).

Most direct spending is comprised of “entitlement programs”—where eligibility rules, benefit formulas and inflation adjustments enacted in permanent law determine annual outlays. Consequently, entitlements and other direct spending programs are on “auto-pilot” until underlying laws are changed.

The three largest entitlement programs, together comprising nearly half of the budget, are Social Security, Medicare and Medicaid.

Social Security: nearly $1.6 trillion in outlays and 22% of the budget, pays old-age, survivors, and disability benefits from payroll tax receipts and trust fund reserves.

Medicare: $992 billion and 14% of the budget is the national health insurance program administered by the federal government for seniors and disabled adults, and financed by payroll taxes, premiums, copayments, and general tax revenues.

Medicaid: $668 billion in outlays and 10% of the budget, is the major health and long-term care program for low-income children, families, and seniors—financed jointly by the federal and state governments and administered by the states.

Net Interest Payments on the Debt: 15% of the Budget and Rising

The third category of federal spending is “net interest,” which was $1.028 trillion in FY 2025, 15% of total federal outlays.

Because of the rapidly rising public debt, net interest is projected to become the fastest growing portion of the federal budget, increasingly crowding out available funds for defense and nondefense discretionary programs.

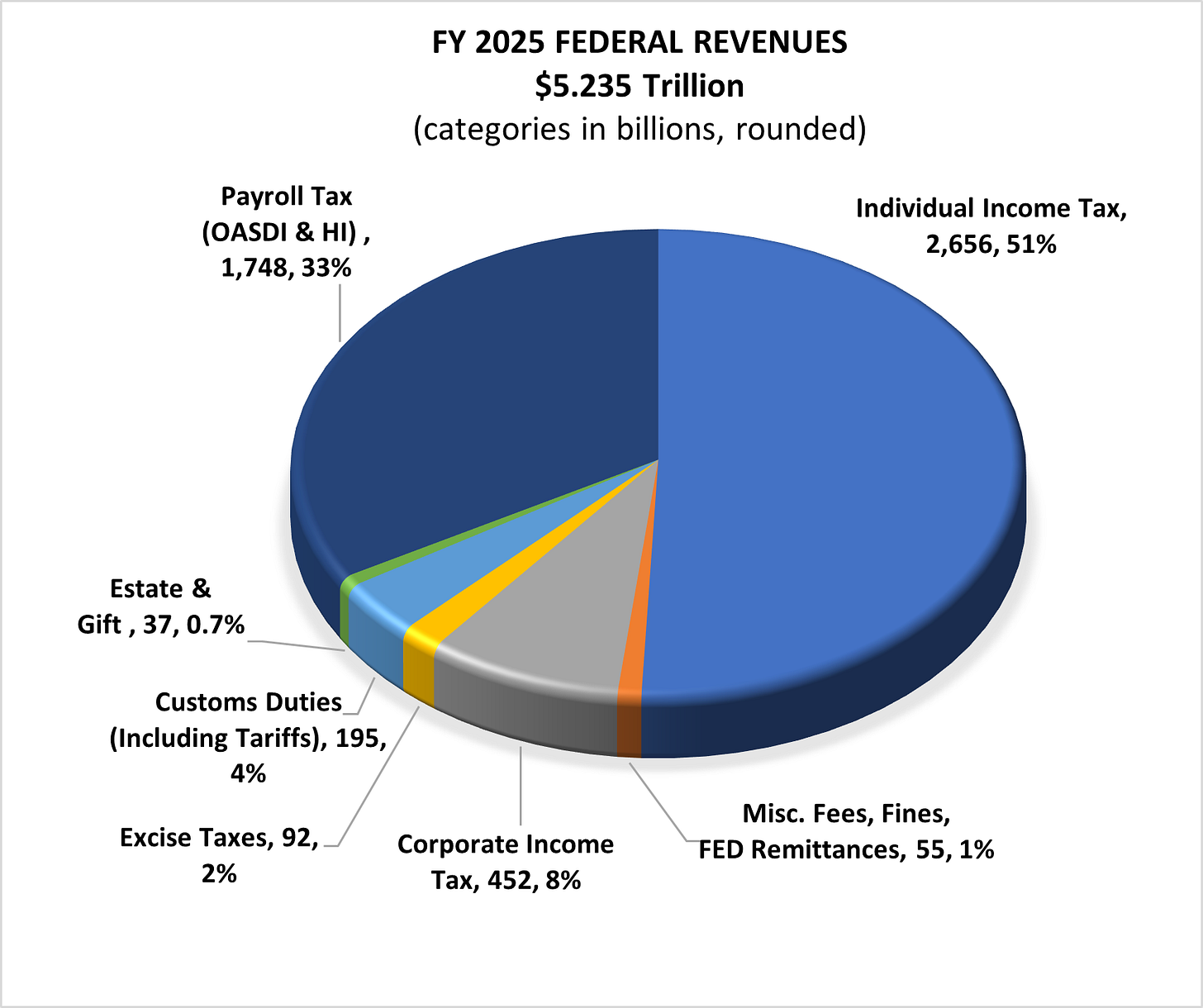

FEDERAL REVENUES

As displayed in the figure below, federal revenues consist of governmental receipts from the individual income tax, payroll taxes, corporate income tax, federal reserve remittances, excise taxes, custom duties (including tariffs), and the estate and gift tax. Revenues in FY 2025 totaled $5.235 trillion.

Data Source: Congressional Budget Office Baseline and End of Year Summary.

(Numbers will be updated when the CBO Budget and Economic Outlook is released in January 2026.)

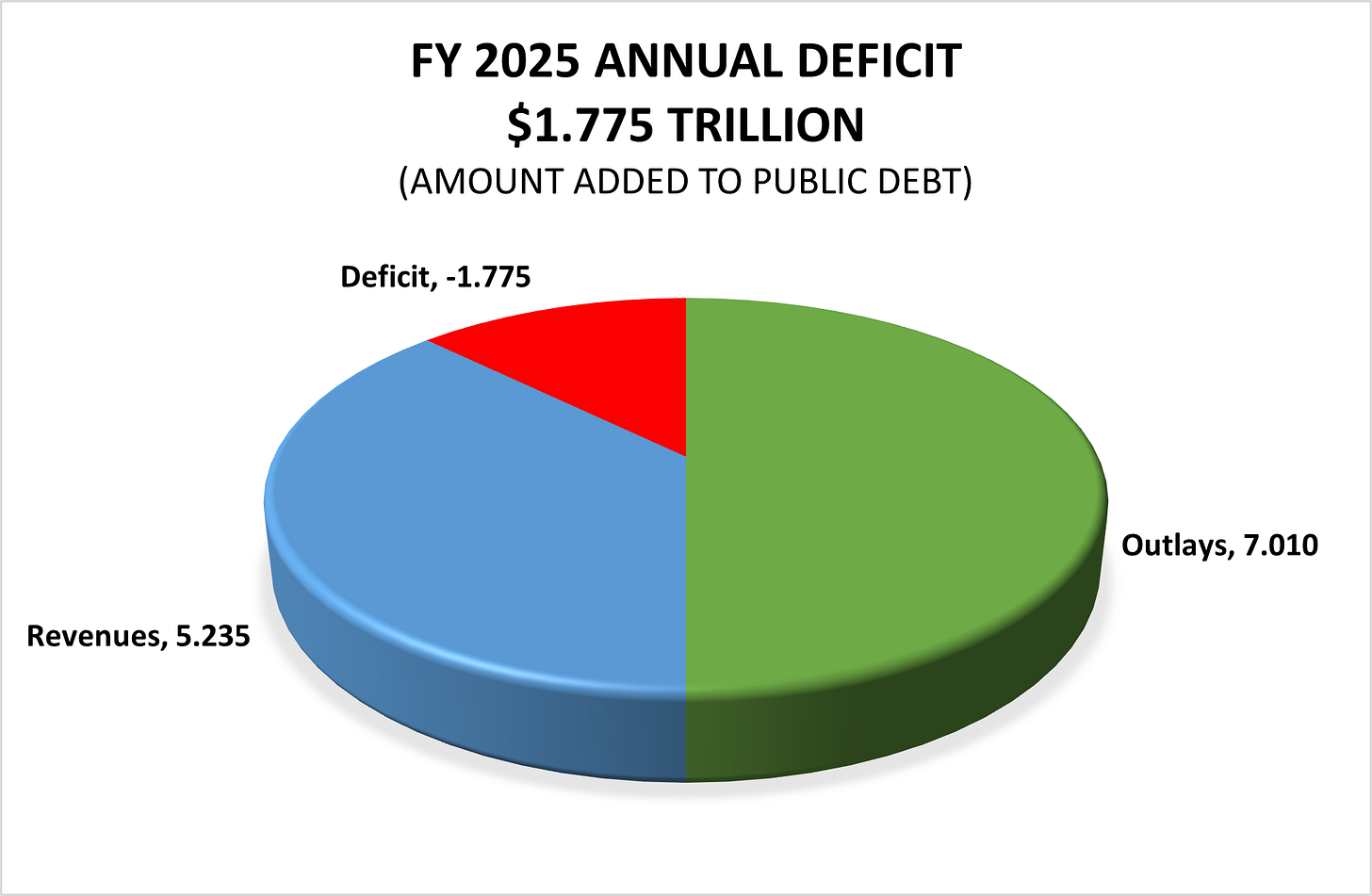

ANNUAL DEFICIT

As displayed in the pie chart below, the annual deficit of $1.775 trillion in FY 2025 is the amount by which federal spending exceeded federal revenues. Each year the federal government runs an annual deficit, Treasury issues bonds to to finance the shortfall, and that amount is added to the accumulated public debt. For more background on the current national debt, link to our “Debt” page.

As you can see, there is no “extra cash” available from tariff receipts for payment of so-called “tariff dividends.” Tariff receipts have simply reduced, by a small fraction, the amount of money Treasury had to borrow in 2025 in order to cover the budget shortfall. Payment of “tariff dividends” or “tax rebates” in 2026 would increase the annual deficit and the accumulated public debt.